by Rosario Guzman

The Duterte presidency is nearing the end of its term, yet we don’t seem to be anywhere near the fulfilment of the big infrastructure dream of the administration. Build Build Build is supposed to be the centerpiece of what could be a Duterte legacy, but the program’s performance is far from defining a grand exit for the administration.

The number has changed

Only 11 of the more than 100 infrastructure flagship projects or IFPs have been completed as of May 2021. The National Economic and Development Authority (NEDA) lists another 12 IFPs that may be done by the end of 2021 and another 17 by the end of 2022. If these were even feasible, there would be a total of 40 finished projects under Pres. Duterte’s watch.

The government started with a list of 75 IFPs in 2017. In 2020, NEDA revised the list twice – increasing this to 104 and then to 112 (no longer including the 7 of the 11 finished projects). It retained only 42 of the original 75 and added new ones that are more doable, or that are not even defined as public works such as the national ID system, or projects that are merely continued from previous administrations. The list was obviously revised to increase the chances of completing a respectable number of projects.

Of the 11 projects completed so far, six were not included in the original 2017 IFP list. Two of these six – the LRT 2 East Extension and the Metro Manila Skyway Stage 3, were even started under the previous administration. Of the 12 IFPs expected to be finished by the end of this year, 11 are new additions to the list including two previously identified projects that had also been started long before Pres. Duterte’s term – the Unified Grand Central Station (a previous commitment by the Arroyo administration but was stalled due to disputes) and the Malitubog-Maridagao Irrigation Project (started in 2011). Of the 17 IFPs for completion by end of 2022, only the Chico River Pump Irrigation Project was in the 2017 list, while the rest were only added last year.

Even if we do see the completion of these 29 IFPs by the end of 2021 and 2022, all the finished projects will still just amount to Php365.24 billion which is only 7.8% of the total project cost of Php4.7 trillion for all targeted IFPs. Much remains to be done actually, with 51 projects going beyond 2023 while 28 others are still in the pipeline.

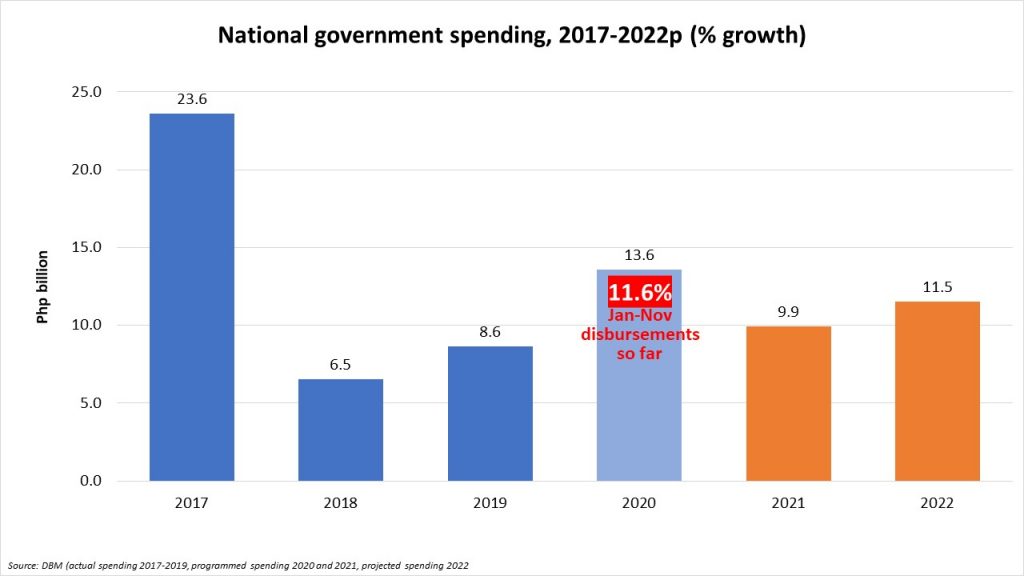

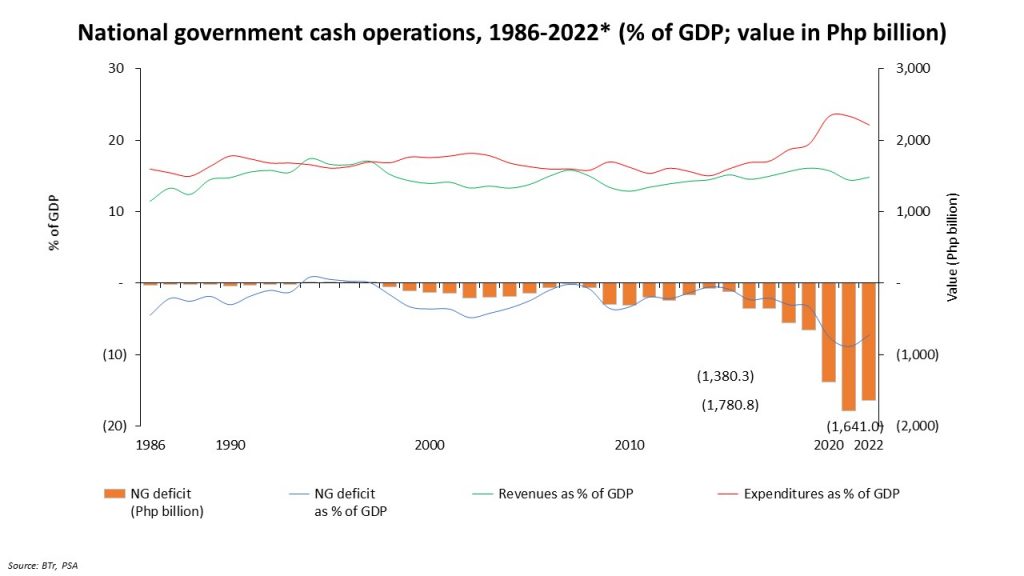

Driven by debt and private capital

Nevertheless, the Duterte administration has already crowed about its unmatched performance in infrastructure, citing as an indication of its seriousness the almost 100% increase in government spending for this, from Php590.5 billion in 2016 to Php1,019 billion in 2021. It has increased infra spending as percent of the gross domestic product (GDP) from 3.9% in 2016 to 5.1% in 2021. The annual average of 5% infra spending as percent of GDP in 2017-2021 even surpasses the annual average of 3.4% under the Marcos dictatorship. This is even despite the 21.4% decline in disbursements last year due to the pandemic.

In the Sulong Pilipinas forum of the administration in April this year, the economic managers took turns highlighting how the administration has boldly financed infrastructure for economic development in contrast to the Aquino administration’s lackluster performance.

However, more than half (56%) of the indicative amount for the IFPs is from official development assistance (ODA), mostly as loans, while only 3.9% comes purely from the General Appropriations Act (GAA) or the national budget. Conspicuously, there are now 20 unsolicited public-private partnerships (PPPs) where there was none before, comprising 32% of total cost.

There are seven other PPPs worth Php244.2 billion or another 5.2% of the total cost. Five of these PPPs, all expressways, are components of the Supplemental Toll Operation Agreement (STOA) entered into by the government’s Toll Regulatory Board (TRB), Ramon Ang’s Citra Central Expressway Corp., and the Philippine National Construction Corporation (PNCC). STOA ensures the identification, adjustments and collection of toll rates upon the completion of the projects.

The government has also mixed PPP with ODA in the case of LRT-1 Cavite Extension Project to be accomplished beyond 2023, and with GAA in the case of Metro Cebu Expressway Project which is still in the pipeline. There is also ODA mixed with GAA in the case of Davao City Coastal Road Project to be done after 2023.

PPP was the preferred funding scheme of the Aquino presidency, which was criticized not only for its slowness but more importantly for benefiting the real estate and infrastructure tycoons. The then incoming Duterte presidency declared that the state would proactively make an investment, raising hopes that infrastructure would finally be cheaper and more relevant to public needs. But in reality, the government simply shifted to ODA loans especially from Japan and China; in particular, the share of China ODA to total ODA to the Philippines increased from a negligible 0.01% in 2016 to 2.73% as of 2019. The Duterte presidency also ended up still relying on private capital, unsolicited proposals at that, to expedite projects. Overall, it appears that the promised change of having a genuinely state-led infrastructure development and presumably for maximum public benefit has not come at all.

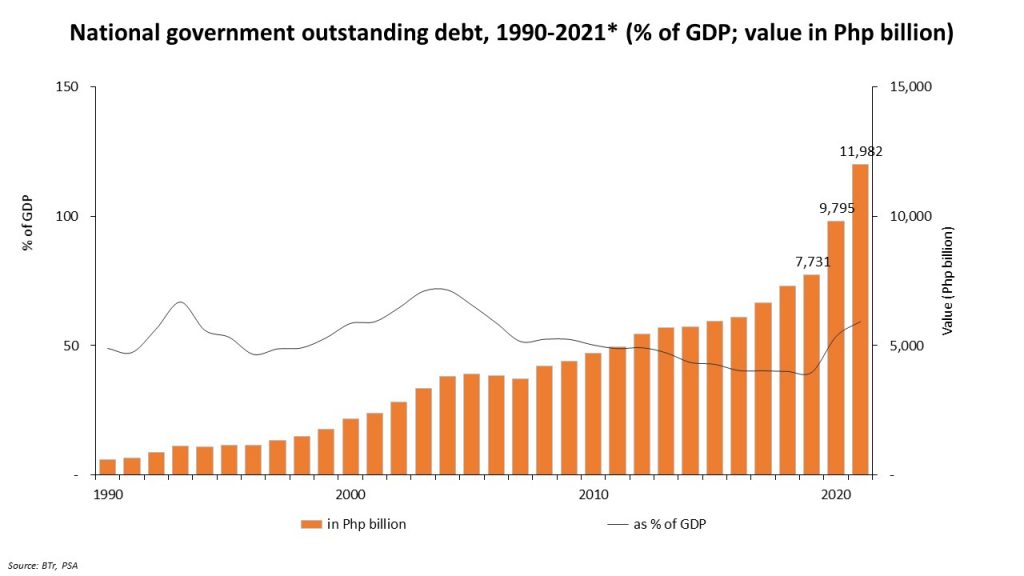

Instead, the administration doubled its gross borrowings from Php507 billion in 2016 to Php902 billion the following year, breaching the unprecedented Php1 trillion mark in 2019 and nearly tripling this in 2020. The national government outstanding debt as of May 2021 is Php11.1 trillion – it was only Php6 trillion when Pres. Duterte took over.

Building up foreign investors and oligarchs

Unsolicited proposals for PPPs from the private sector are allowed under the 1990 Build-Operate-Transfer (BOT) Law (Republic Act 6957 as amended by Republic Act 7718), the country’s watershed legislation towards privatized infrastructure development. These projects do not require direct government guarantee, subsidy or equity, and presumably involves a new concept or technology. The BOT Law also defines and allows the Swiss Challenge as the procurement system to be followed for unsolicited proposals, where upon the project proposal of a private entity, the government invites similar or competitive proposals from third parties which the original proponent can still match afterwards.

Pres. Duterte adopted the Swiss Challenge and eliminated the normal bidding process for public works, wherein the government presents the specifications of the procurement and invites entities to make offers, which could be in an open or closed bidding. Controversially, Malacañang argued that this would quicken the pace of Build Build Build and minimize corruption. On the contrary, the Swiss Challenge can potentially concentrate infrastructure control to only a few proponents as well as government officials. It can definitely lower transparency, such that the novelty of the concept or technology does not get to be subjected to public scrutiny. In other words, the government has skipped the development planning process and relied on what the private sector wants to embark on, thereby making infrastructure inherently exclusive rather than inclusive.

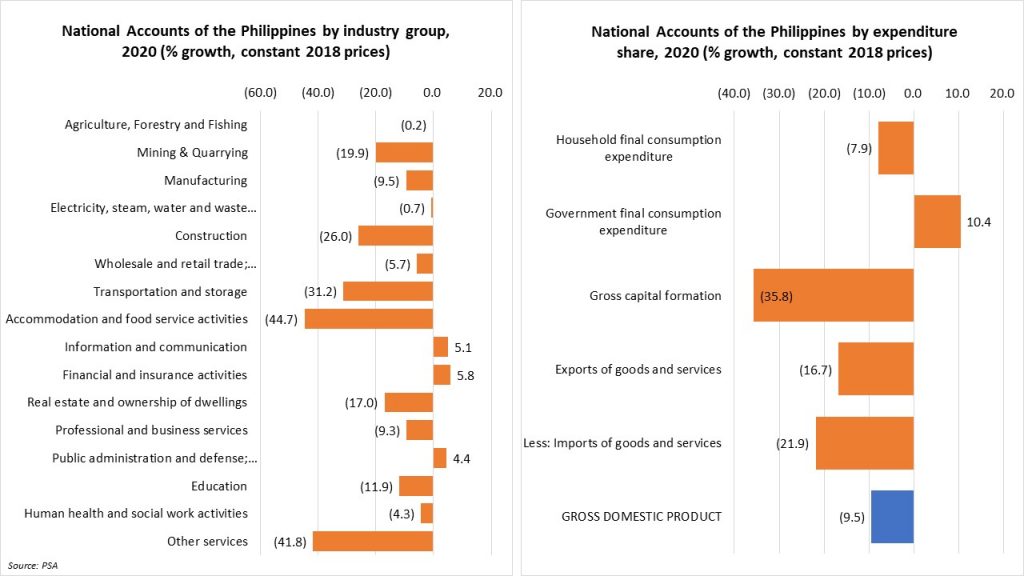

All of the unsolicited PPPs are for transport and mobility. In fact, 76 of the 112 IFPs, or 91% of the total project cost, are for transport and mobility. Likewise with 71% of the total project cost of the 40 projects that the administration hopes to announce as done by 2022. Build Build Build prioritizes transport and mobility as though the country’s transport and traffic problems take precedence over the crisis and stagnation of agriculture and manufacturing.

In reality, the ‘infrastructure ambition’ is about three things for the Duterte administration. It is about providing the infrastructure foreign investors want – to improve connectivity to the economic zones and ease the cost of doing business. The country’s creditors, notably the World Bank and the Asian Development Bank (ADB), have been nagging the Philippine government to make pleasant infrastructure to increase the country’s creditworthiness and investment grade and to attract much-needed foreign investment in the import-export economy. That is visibly the first and basic reason for making Build Build Build look grand and why past administrations had merely focused on providing infrastructure as their primary task in a liberalized and privatized economy.

Secondly, Build Build Build is about providing foreign and local investors and builders the business they want. The Duterte administration wanted to take advantage of the global infrastructure investment glut that was largely untapped in 2016 by flashing a grand infrastructure menu card. In short, it has promoted infrastructure as the foreign investment destination, along with energy, water and public utilities which also have vast infra needs. This has immensely enriched foreign infra, utilities, construction and transport technology corporations despite the rise in global interest rates and prolonged global economic slide. And now, despite the pandemic and declining global investments, the Duterte administration continues to sell the dream.

Thirdly, Build Build Build is about boosting the wealth of the country’s economic oligarchs, especially those in real estate construction, ports building, transportation, energy and water, and the consequent speculation on values of land and natural assets. International and national media have observed how Pres. Duterte has empowered a new business elite, the “Dutertegarchs”, and created his own set of cronies who have benefited from full-scale liberalization of foreign investments and private capital in otherwise public goods and domain.

Legacy of deeper crisis

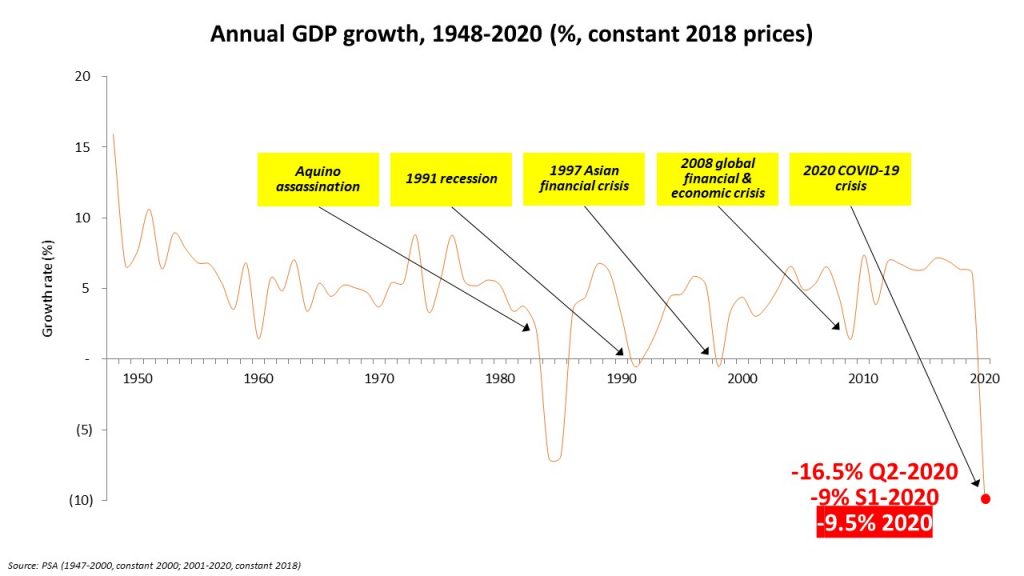

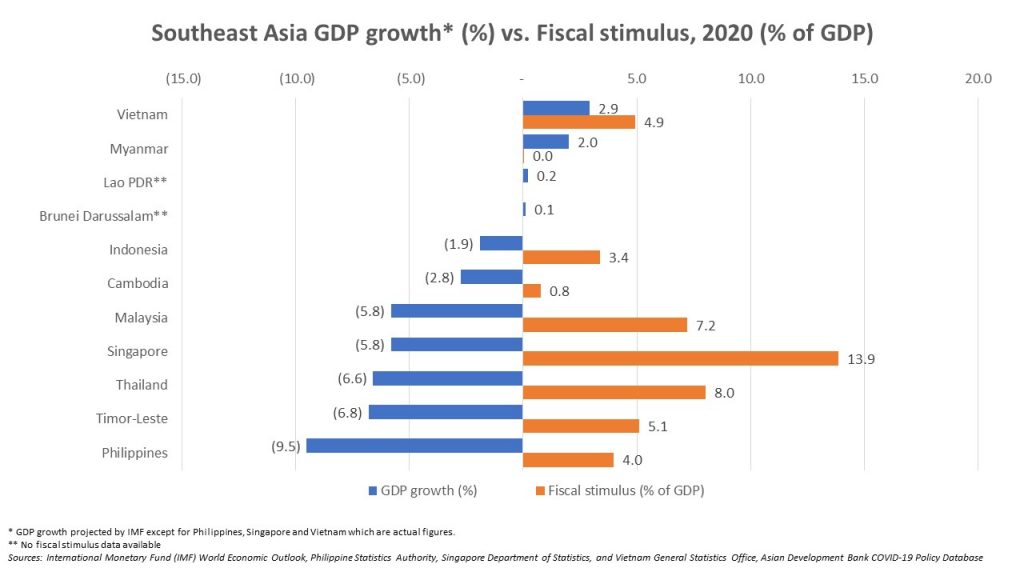

Much of the hyped benefits from embarking on a massive infrastructure program have failed to materialize. Build Build Build has been the Duterte administration’s only hope to arrest the economic slowdown pre-pandemic, and now to recover the economic collapse during the pandemic and beyond.

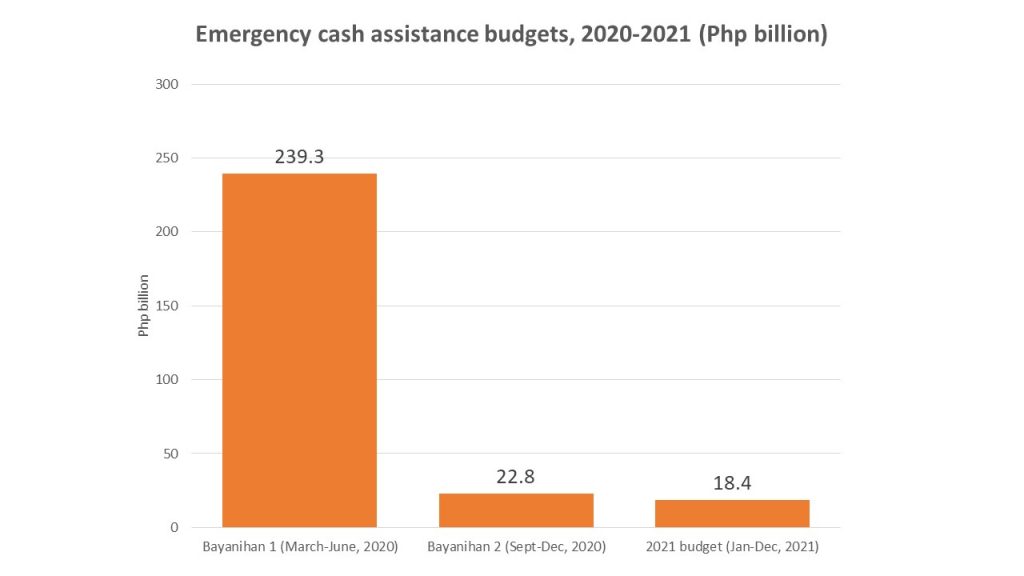

But it has been the wrong choice of policy from the start. The economy needs mending in its production sectors, especially those catering to domestic needs and that have the capability to create meaningful jobs for the mass of jobless and sustainable incomes for the poor majority. But the government has chosen to spend on boosting investor confidence and opportunities. Even spending on health pales in comparison with the Php1.1 trillion allocation for infrastructure in the 2021 budget.

Consequently, this wrong policy mindset only boosts the production of infra materials by the corporations of the contracting countries. In the case of ODA for instance, loans are always preconditioned by the host country’s use of the so-called donor country’s contractors, technology as well as businessmen. At one point, China even pushed for the use of its own workers in Philippine projects. Consequently, this has increased the country’s imports bill, resulting in the country’s worst trade deficit. But the more important consequence is that Build Build Build’s reliance on foreign contractors and materials has undermined our chance of locally producing these materials and building our own infrastructure using local resources. Even the absorptive capacity, the ability to “learn and use” external knowledge, of the Department of Public Works and Highways (DPWH) and Department of Transportation (DOTr), is limited.

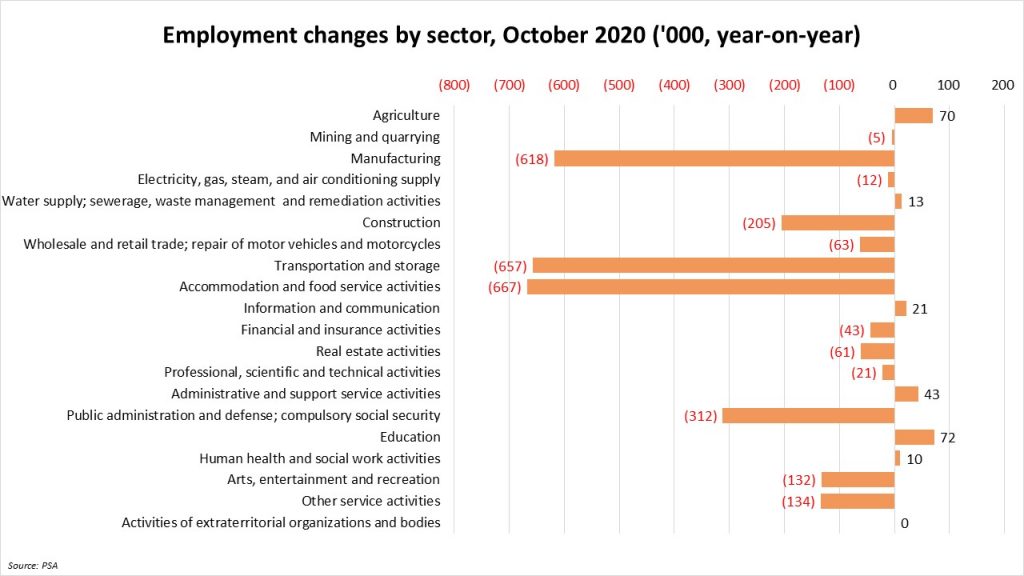

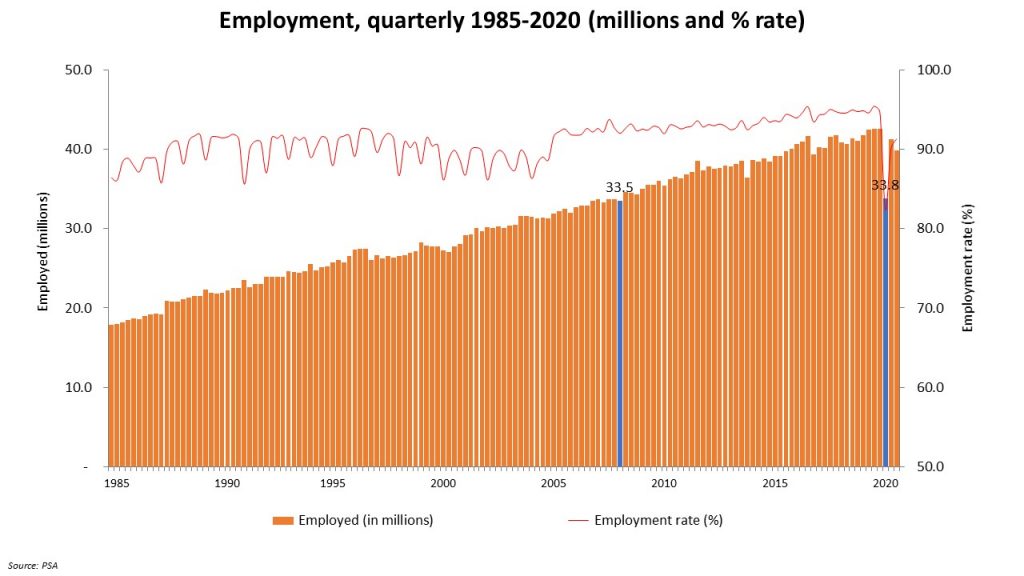

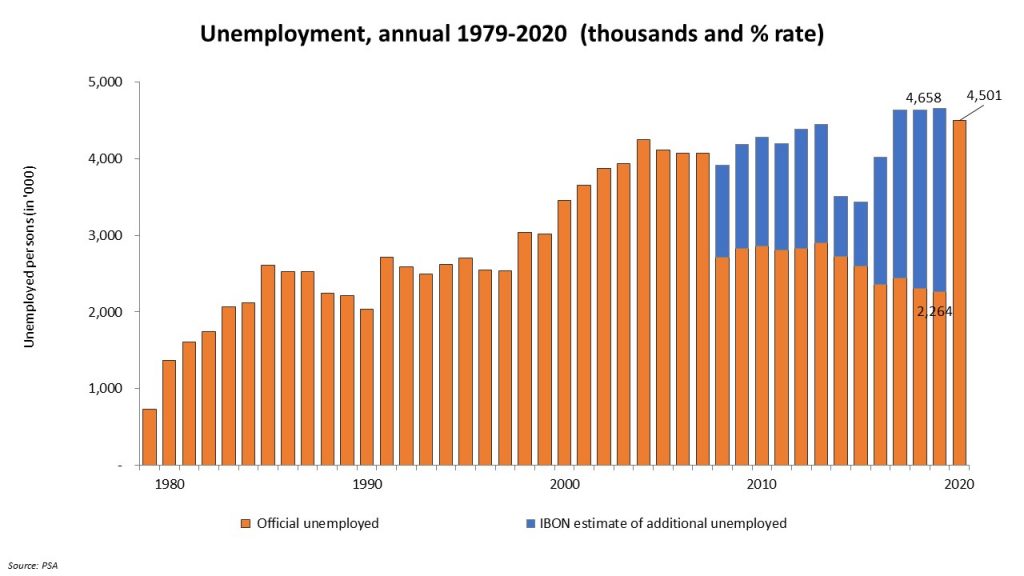

Build Build Build has also failed to deliver the jobs generation that the administration has imagined as one of the benefits. Every year since 2017, the growth in construction employment has been a lot smaller than in 2016. The projected job generation from Build Build Build of 1.2 million annual average in 2017-2022 is a far cry from reality. The annual average job generation from all sectors pre-pandemic or 2017-2019 only reached 313,000,[1] the lowest among all administrations post-Martial Law. We lost 2.6 million jobs last year.

Optimists have looked forward to the public services that may be improved with the finished projects, even if these are not exactly the kinds of infrastructure that are much needed to recover lost jobs and incomes. But that is also one of the follies of debt-driven and privatized infrastructure development – we get to pay for these increasingly irrelevant projects with our taxes and high user-fees. Build Build Build has been backed by the most regressive tax reform the country ever had and the built-in automatic upward adjustments in toll fees, fares and other user-fees.

In all probability, in the future post-pandemic as the economy yields lower returns on investment, the debt owed today will be more expensive than initially computed. This will mean heavier debt burden, more anti-poor and regressive taxes, and higher user-fees for so-called public services. In all certainty by then, we can say that the grand infrastructure age has delivered a legacy of untold poverty and deeper economic crisis. #

[1] Average of 2017-2019 only because of change to 2013 Master Sample Design in 2016

= = = = =

Kodao publishes IBON articles as part of a content-sharing agreement.