by Sonny Africa

Executive Director, IBON Foundation

The Duterte administration’s economic managers made some odd statements as the year wound up. Economic planning secretary Ernesto Pernia said “the Philippine economy became stronger and even more resilient than ever”. Finance secretary Carlos Dominguez III insisted on “the soundness of the Duterte administration’s economic development strategy”. Bangko Sentral ng Pilipinas (BSP) governor Nestor Espenilla meanwhile said that they “expect growth to remain solid in the years ahead”.

These are odd because the economy clearly showed signs of increasing stress in 2018. If anything, the year just passed confirmed the end of the long period of relatively rapid growth for the Philippines.

In denial

Growth has been slowing since the start of the Duterte administration. It is already its slowest in three years. Inflation reached a nine year-high and was even worse for the poorest Filipinos. The current account deficit is at its worst in 18 years. The peso is at its weakest in 13 years. International reserves are in their lowest in 10 years. The jobs crisis is disguised but really at a historic high. Overseas remittances are also slowing — this further dampens household consumption and welfare.

The government seems to think that it can just spend its way out of this. It holds its ‘Build Build Build’ infrastructure offensive as some kind of magic bullet. This will be difficult with the end of the decade of low global and local interest rates and rising borrowing costs. Accelerating government debt will also only become more unmanageable as growth continues to slow. As it is, the budget deficit is already at its worst in seven years.

All these the government’s chief economic propagandists will euphemistically call ‘headwinds’ or ‘challenges’. Yet barring a real change of economic course, there is little reason to expect that the economy will get better anytime soon. Elite business profits will likely continue to grow, but it may just be a matter of time before even these suffer.

As if being near the top of a sinking ship is a good thing, the administration will keep on claiming that the Philippines is among the fastest growing economies in the region and in the world that is caught in a protracted crisis, Still, the 6.3% growth in the first three quarters of 2018 is markedly slower than the 6.7% growth on 2017 and 6.9% in 2016.

Deteriorating

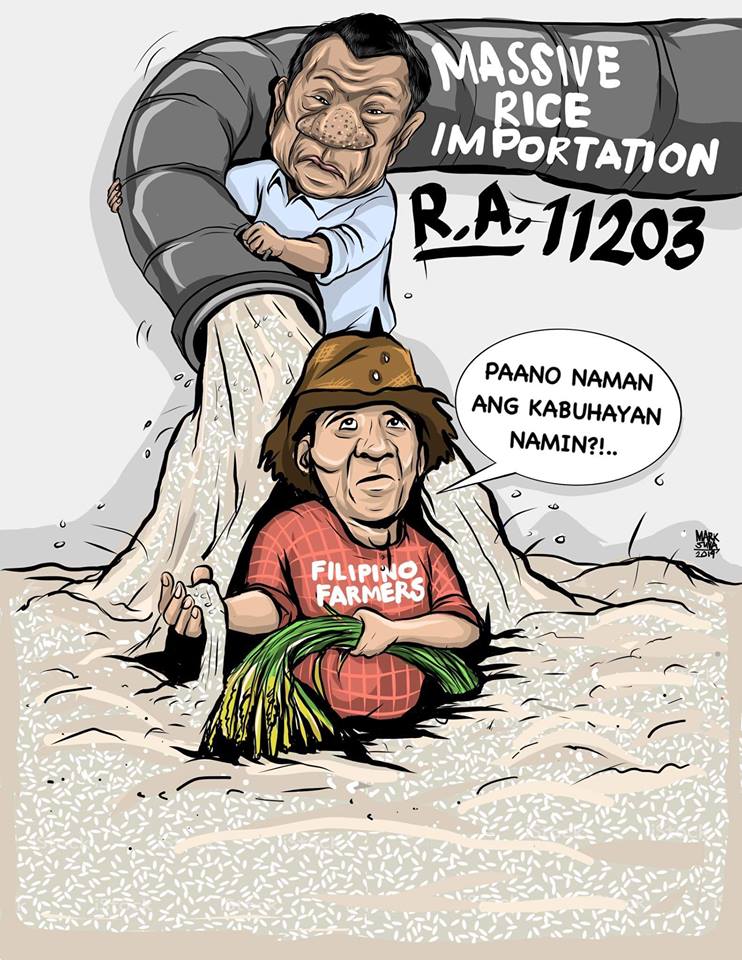

Agriculture is doing particularly badly: its 0.4% growth in the first three quarters of 2018 is approaching its worst performance since 2016. But even the hyped manufacturing resurgence is hitting a wall – the 5.7% growth in the first three quarters is much slower its 8.4% clip in 2017, and the full year results may be the slowest since 2015.

Filipino industry and domestic agriculture would have been solid foundations of domestic demand and production, if only these had really been developed these past years. This is impossible though under the government’s obsolete globalization and free trade mantra. Agriculture is still left to the vagaries of the weather and small peasant labor. Manufacturing remains shallow and foreign-dominated.

The services sector never should have been the driver of economic growth. But even this is failing. The real estate boom appears to be ending with 5.9% growth of finance and real estate in the first three quarters of 2018 continuing the trend of slowing growth from 7.5% in 2017 and 8.5% in 2016. Reflecting weakening household consumption, even trade is down – at just 6.0% in the first three quarters compared to 7.3% in 2017 and 7.6% in 2018.

The main drivers of growth in 2018 have been the intrinsically short-term boost from government spending – this increased to 13.1% growth in the first three quarters from just 7.0% in 2017. , Construction also increased to 13.3% growth in the first three quarters from just 5.3% in 2017.

Real score on jobs twisted

The worst effect of a backward economy is not creating enough decent work for the growing population.

The economic managers hailed 825,000 new jobs created in 2018 and unemployment falling by 140,000 bringing the unemployment rate down to 5.3 percent. Unfortunately, these do not tell the whole story.

The Duterte administration has actually created just an average of 81,000 jobs annually with 43.5 million jobs in 2018 compared to 43.4 million in 2016. This is because the economy lost a huge 663,000 jobs in 2017, which was the biggest contraction in employment in 20 years or since 1997.

So the largest part of the supposed job creation, or some four out of five ‘new’ jobs, was really just restoring jobs lost in 2017.

But how to explain the falling unemployment? This is a statistical quirk. According to the official methodology, jobless Filipinos have to be counted as in the labor force to be counted as unemployed.

It seems that huge numbers of Filipinos are no longer seeking work and dropping out of the labor force. This is reflected in how the labor force participation rate dropped to 60.9% in 2018 which is the lowest in 38 years or since 1980.

While employment grew by just 162,000 between 2016 and 2018, the number of workers not in the labor force grew by a huge 2.9 million over that same period. It is likely that the reported 62,000 fall in the number of unemployed between 2016 and 2018 reflects workers dropping out of the labor force because of tight labor markets rather than their finding new work (because of weak job creation).

This scenario is supported by IBON’s estimates of the real state of unemployment in the country. The government started underestimating unemployment in 2005 when it adopted a stricter definition that made subsequent estimates incomparable with previous figures.

Reverting to the previous definition to give a better idea if the employment situation really is improving or not, IBON estimates that the real unemployment rate in the decade 2008-2017 is some 10.2 percent. This maintains high unemployment in the economy since the onset of globalization policies in the 1980s. IBON does not yet have estimates for 2018, but the real number of unemployed in 2017 was 4.6 million or almost double the officially underreported estimate of just 2.4 million.

Job generation trends in 2018 are in any case worrisome as it is. The quarterly labor force survey showed drastically worsening job generation since the start of the year. Measured year-on-year, some 2.4 million jobs were reported created in January 2018 but this fell to 625,000 in April then 488,000 in July and then 218,000 jobs actually lost, rather than created, in October.

Economy needing rehab

Perhaps high on their own propaganda, the country’s neoliberal economic managers continue to confuse abstract growth figures, business profits and foreign investment with development and the conditions of the people. The reality however is of chronically backward Filipino industry and agriculture and an economy that went sideways in 2018. The real challenge is to discard failed neoliberalism and to replace this with an economics truly serving the people.#