Sa pagtindi ng kahirapan, patindihin ang paglaban

Ni Nuel M. Bacarra

Sa panahon ng batas militar noong kalagitnaan ng dekada sitenta, umabot ng ₱8.00 ang isang salóp ng bigas sa Mindoro. Katumbas ang isang salóp ng 2¼ kilo o halos ₱3.55 bawat kilo. Noong umabot na sa ganito ang presyo ng bigas, may pagkakataon na may kisa o halong mais na ang kanin sa hapag. Hindi pa uso ang pangyayaring El Niño noon subalit ganito na ang larawan ng kahirapan noon sa probinsya.

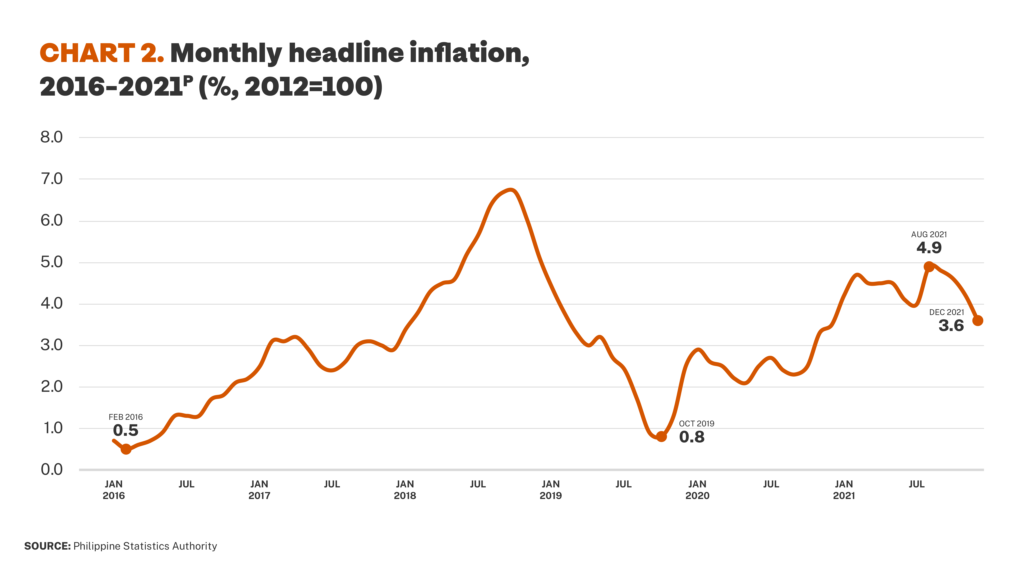

Sa ngayon, ang bigas ay naglalaro na sa halos ₱55 – ₱60 kada kilo para sa regular milled at well-milled na bigas. Ang implasyon sa bigas ay umaabot sa 23.7% na pinakamataas sa loob ng 15 taon. Kasabay pa ito ng halos kada linggo na pagtaas ng presyo ng langis na nagiging sanhi naman ng pagtaas ng presyo rin ng iba pang pangunahing bilihin.

Todo-higpit na ang sinturon ng karaniwang pamilya dahil lalong tumitindi ang kahirapan. Hanggang saan ang sukdulan ng pagtaas ng presyo ng bigas? Sa mahigit limang dekadang singkad, may ibayong pagtindi ang anyo ng kahirapan sa bansa sa bawat dekada, sa bawat taon. Marami na ang hindi nag-aalmusal sa ngalan ng pagtitipid. Sa ganitong kalagayan, tila ang kulang na lamang ay ang pamiliin ng gobyerno ang taumbayan kung nais nilang kumain ng dalawang beses isang araw o minsanan na lamang.

Hagupit ng kalikasan at kainutilan

Noong nakaraang buwan mayroong magsasakang nagpakamatay na sa isla ng Mindoro dahil natuyo na lamang ang kanyang pananim dahil sa sobrang init na dulot ng El Niño at walang napakinabangan dito. Sa unang pagtaya ng Department of Science and Technology, 48 na mga prubinsya ang maapektuhan ng malalang tagtuyot at 24 naman ang makararanas ng dry spell. Tagtuyot kung dumaranas ang isang lugar ng limang sunud-sunod na buwan ng matinding init bunga ng kawalan o mas mababang porsyento ng ulan habang maikakatergorya ang isang lugar na nasa ilalim ng dry spell kung nakakaranas ng tatlong magkakasunod na buwan na ‘di umuulan.

Ang El Niño ay ang pag-init ng ibabaw ng karagatan na mataas kaysa karaniwan na temperatura sa gitna at silangang bahagi ng Pasipiko. Epekto na ito ng pagsalaula sa kalikasan ng mga tao sa kumpas ng malalaking korporasyon sa buong mundo na walang humpay na gumagamit ng fossil fuel na nagpapataas sa temperatura ng karagatan dahil sa carbon dioxide. Ang malalaking tipak ng yelo sa tuktok a talampakan ng mundo ay natutunaw na nagpapataas naman ng lebel ng tubig na nagdudulot naman ng pagbaha at pagkawala ng mga natural na tirahan ng mga hayop at halaman na nabubuhay sa tubig.

Ang El Niño at La Niña (kabaligtaran naman ng una, na mas madalas ang insidente ng pagbaha dahil sa mga bagyo at habagat) ay siklo na pamalagian nating dinaranas dahil sa pagbabago ng temparatura ng karagatan. Ayon sa mga eksperto, nagaganap ang siklo tuwing 2 – 9 na taon at tumatagal ng siyam hanggang 12 buwan. Sa anunsyo ng Philippine Atmospheric, Geophysical and Astronomical Services Administration o PAGASA noong huling kwarto ng 2023, mararamdaman ang epekto ng El Niño sa bansa sa unang kwarto ng 2024 hanggang Abril. Subalit sa pabatid nitong huling linggo ng Marso, maaaring tumagal ang El Niño hanggang Agosto kung saan ilang prubinsya pa ang makararanas ng tagtuyot at dudugtong naman ang La Niña na kailangang paghandaan ng bansa. Nitong unang linggo namanng Abril, tanging ang Batanes at Saranggani na lamang ang deklaradong mga prubinsyang hindi tinamaaan ng El Niño sa buong bansa.

Pero sa halip na paghandaan ito nang lubos ng pamahalaan sa pamamagitan ng mas masusing syentipikong pag-aaral sa mga epekto nito at kahandaan na alalayan ang mamamayan sa pamamagitan ng pagbibigay ng ayuda sa mga apektadong sektor laluna sa mga magsasaka, mas minabuti nitong pairalin ang korupsyon at kalingain ang mga rice trader kaysa sa mga magsasaka at iba pang sektor na ibayong nagpasiklab sa damdamin ng mga mamamayang direktang apektado ng sakuna.

Singil sa Anomalya

Sa ganitong dinaranas na sakuna, litaw ang tagibang na prayoridad ng gobyernong Bongbong Marcos Jr. Mas tiniyak ang katiwalian at ang pagbibigay ng pabor sa mga negosyante kaysa pagsilbihan ang maralitang mamamayan at higit na mga nangangailangan.

Pumutok ang isyu ng pagbebenta ng National Food Authority (NFA) ng mga lumang imbak na bigas kamakailan. Ibinenta ng mga opisyal ng ahensya ang 75,000 sako ng bigas sa halagang ₱25/kilo sa rice traders sa panahong ang tinging presyo ng bawat kilo ng bigas ay nasa ₱70 /kilo ayon sa imbestigasyon ng mababang kupulungan ng Kongreso. O di kaya naman kaya ay inilagak ang mga istak na bigas sa ipinagmamalaking tindahan ng Kadiwa para mapakinabangan ng maralitang mamamayan.

Hindi na ito bago sa NFA. Noong 2021, nagbenta rin ang ahensya ng 5.6 milyong sako ng bigas at apat na milyong sako noong 2022 sa rice traders. Ang kaibahan sa kasalukuyan, nasa yugto ang bansa ng pananalasa ng El Niño na disin sana’y maaaring gawing pang-ayuda sa mga biktima na dumaranas ng gutom at sa mga magsasakang matinding tinatamaan nito. Malaking tulong sa mamamayang nagugutom at kung ipinamahagi ito sa presyo na katumbas ng pagbebenta sa mga rice trader.

Hindi kayang tabunan ng diumanong mahigit isang bilyong pisong halaga ng suporta mula sa Department of Agriculture (DA) sa mga magsasaka ang katiwalian sa NFA. Sa pagkakataong ito na sinasalanta ng hagupit ng El Niño ang kabuhayan ng pinakamalaking bahagdan ng populasyon, hindi katanggap-tanggap ang kalagayan na habang nagdurusa ang mamamayan, kumikita sa katiwalian ang mga ahensya ng gobyerno at sa prayoridad na ibinibigay sa mga kasabwat sa mga maanomalyang gawain.

Nitong Abril 3, kinalampag ng mga magsasaka at mga tagasuporta nila ang tarangkahan ng pambansang tanggapan ng NFA sa Quezon City para singilin ang matataas na upisyal ng ahensya at papanagutin ang mga ito. Bukod pa rito ay humihingi ang mga magsasaka ng kumpensasyon sa pagkalugi nila dahil sa kapabayaan ng gubyerno para paghandaan ang sakuna.

“Nasaan na ang imbestigasyon na ginagawa ng Department of Agriculture at ng Kongreso na hanggang ngayon ay wala pa ring napapanagot. Hindi sapat na i-suspend ng anim na buwan ang mga namuno doon sa pagbebenta ng 75,000 bags na bigas. Yung mga ginawa din nila na pagpa-padlock sa 79 na warehouses ay hindi rin makatarungan bagkus yung mga mahigit 100,000 bags pa ng bigas sa mga warehouse na ‘yan ay kagyat nang ipamahagi sa mga biktima ng mga kalamidad kung hindi man ay direktang ibenta ito diretso sa mamamayang Pilipino na naghahanap ng mababang presyo ng bigas,” pahayag ni Cathy Estavillo, tagapagsalita ng Bantay Bigas Network noong Abril 3 sa harap ng tanggapan ng NFA.

Ang kahirapan ng mga magsasaka ay sinisingil nila dahil sa pagiging kontra-magsasaka at kontra-mamamayan at inutil na gobyerno tulad ng pahayag naman ni Danilo Ramos, tagapangulo ng Kilusang Magbubukid ng Pilipinas.

“Ang mga patubig, walang tubig! Kaya po mayroong dating umaani nang otsenta, ngayon ay siyam na kaban. At katulad po ng inyong lingkod, marami sa ibang lalawigan, hindi nag-ani. Wala na ngang lupa, gutóm!” ani Ka Daning.

“[D]apat po nating makita kung bakit may krisis sa pagkain, El Niño at kalamidad ay dahil mismo sa gubyernong inutil, kontra-magsasaka, kontra-mamamayan. Ang sabi ng mga magsasaka, aanhin pa ang damo kung patay na ang kabayo? Matagal na po naming hiling ang ₱15,000.00 na tulong-ayuda pero hanggang ngayon ay wala! Pero pag sa byahe, pag sa ChaCha (charter change) meron! Kaya mula ngayon hanggang sa hinaharap, palakasin natin ang ating paglaban! Panagutin ang rehimen!” dagdag n glider-magsasaka.

Tuluy-tuloy na pakikibaka

Umabot na ang pinsala ng El Niño sa agrikultura sa mahigit ₱1.2 bilyon ayon sa huling ulat nitong Abril 3 ng National Disaster Risk Reduction and Management Council. Ang halagang ito ang tinatayang katumbas ng 44,845.42 metric tons na pinsala sa agrikultural na produkto. Umaabot sa 17 lugar sa bansa ang nakakaranas ng matinding kalamidad na sangkot ang 84,731 pamilya.

Kung itatapat ang halaga ng pinsala sa ayudang ipinangangalandakan ng DA, lalabas na kulang ito batay sa aktwal na tala ng mga pinsala sa mga prubinsyang malupit na tinamaan ng sakuna. Kung ang isang bag ay umaabot ng 50 kilo, aabot ng ₱93.75 milyon ang halaga ng naibenta ng NFA kamakailan lang. Kung kukwentahin din ang naibenta noong 2021 at 2022 na umaabot sa ₱12 bilyon, malaking bagay na sana itong pagkukunan ng ayuda at kumpensasyon sa mga magsasaka sa ngayon.

Subalit hindi ganito ang kalakaran ng “korupsyon at transaksyong sindikato sa gubyerno.” Ang pondong mula sa buwis ng mamamayang Pilipino ay pribadong inaangkin ng mga sangkot na tiwaling mga opisyal sa gubyerno.

May mandato dati ang NFA na bilhin ang mga aning palay ng magsasaka na mabuting bagay sana para sa mga magsasaka. Subalit nang maging batas ang R.A. 11203 o ang Rice Tariffication Law, naging inutil ang NFA dito at naging instrumento pang lalo sa katiwalian.

Pinapatay na ang mga magsasaka ng kawalan at kakulangan ng lupang masasaka dahil ang mga nagsiupong rehimen mula noong panahon ng diktadura ay kundi man mga panginoong maylupa at mga kumprador na kasabwat ng mga imperyalistang dayuhan sa pagpapanatili ng pyudal at malapyudal na kaayusan sa bansa. Hanggang ngayon ay usapin sa mga magsasaka ang paggigiit ng pagkakaroon ng tunay na reporma sa lupa. Iniaasa sa ngayon sa importasyon ng mga pangunahing agrikultural na produkto na kayang likhain dito sa bansa.

Walang ibang aasahan ang pinakamalaking pwersa sa produksyon ng bansa at iba pang sektor ng lipunan kundi ang patuloy na ipaglaban ang paggigiit ng tunay na reporma sa lupa at pambansang industriyalisasyon. Nilalamon ang sistema ng mga imperyalistang imposisyon ng liberalisasyon, pribatisasyon, deregulasyon na lubos na ipinaghihirap ng mamamayang Pilipino at ikinayayaman naman ng papet na rehimen at mga kasabwat nila sa bansa.

Siklo ang daranasin nating natural na delubyo subalit permanente ang kahayukan sa kapangyarihan, katiwalian at kainutilan ng mga papet na rehimen. Kaya dapat tuluy-tuloy na kumiklos ang mga magsasaka at manggagawa at ang iba pang sektor para baguhin ang sistematikong pagsasamantala at pang-aaping ito sa mamamayang Pilipino. #