Harassment against Hong Kong migrant workers imperils their employment opportunities and prompts them to incur more debt. Governments are aware of the problem, but advocacy groups say regulations and enforcement are not enough.

BY CHERRY SALAZAR / Philippine Center for Investigative Journalism

(Last part of the series)

Many Filipinos working in Hong Kong are hounded by their lenders from the Philippines, who even hire debt collectors to threaten and harass their employers.

The Philippine Center for Investigative Journalism (PCIJ) found that Hong Kong employers have received threatening calls and visits from the debt collectors demanding payment for the Filipinos’ mounting debts.

In extreme cases, the employers would receive snakes or photos of their pets with eyes crossed out in their mailboxes or find their door with red paint.

“Marami pong kasong ganyan (There are many such cases),” Dolores Balladares-Pelaez, chair of the United Filipinos in Hong Kong, an alliance of Filipino migrant groups, told PCIJ. “Of course, the employers get angry and are stressed out.’’

Some Hong Kong employers have since required applicants to have no standing debt. For good measure, some confiscated the worker’s passport and contract on arrival that otherwise could be used as loan collateral, an act that is prohibited by Philippine and Hong Kong laws.

In the Philippines, applicants take out loans at interest rates higher than eight percent per annum — from lenders specifically referred by recruiters — to pay for a raft of excessive fees, including placement fees that are lumped with training and medical examination fees.

As their debts pile up, they’re forced to take out new loans to pay for old ones in an endless cycle of indebtedness.

“The worker’s pay is small. A month’s worth of salary isn’t enough to pay off a loan,” Pelaez said, noting that a migrant worker had to divide the monthly pay between loan payments, family expenses back home, and personal expenses. “So it’s not really enough.’’

In China’s special administrative region, migrant domestic workers are paid a minimum monthly salary of HK$4,730 or P33,000.

The problems are clear, but the solutions are not.

1. OFWs need more guidance during the recruitment process so they do not fall victim to unscrupulous recruiters.

2. Not all violators are punished, promoting a culture of impunity among recruitment agencies and third-party services.

3. Some lenders impose high interest rates.

4. Some lenders shirk responsibility when the debts are sold to partners that harass OFWs to collect payment.

Hong Kong reports 11 convictions

The Hong Kong government, which has allowed foreign domestic helpers (FDHs) to work in the region since the 1970s to meet the shortage of live-in helpers, acknowledged the risk of debt bondage among migrant workers, but has no data on this.

In the past five years, it has prosecuted and convicted 11 employment agencies for overcharging commissions pegged at 10 percent of a worker’s monthly wage. It has also ensured that employers shoulder the workers’ medical examination and visa fees, among others.

But the authorities there said governments should do their part, too, to address the issue of excessive placement or training fees.

In a joint response to PCIJ, the Hong Kong Labour Department, Immigration Department, and Police said the problem lies with “the indebtedness of the FDHs in their home countries before coming to Hong Kong.’’

The Hong Kong government could not tackle this alone, they added.

“We have repeatedly appealed to the governments of FDH-sending countries to address the problem of excessive placement or training fees charged by intermediaries in the FDHs’ home countries so as to tackle the problem of debt bondage at source,” they said.

Migrante International pointed to the Department of Migrant Workers’ mandate and responsibility “to coordinate with the other government agencies that can also put a stop to these cases.”

“But still walang (there’s no) strong enforcement and regulation on these lending agencies and further investigation,” said Joanna Concepcion, chair of Migrante International, a global network of Filipino migrant organizations.

DMW Undersecretary Bernard Olalia admitted that there were regulatory “gaps” concerning agencies that collect illegal fees. He said even some compliant agencies bend the rules “just to find a way to charge the OFW” even if the law clearly prohibits it.

Olalia, however, said the department wasn’t treating these agencies with kid gloves.

Erring agencies with valid licenses are charged with administrative cases and violations of recruitment laws. Other agencies with expired or invalid licenses face criminal cases, he said.

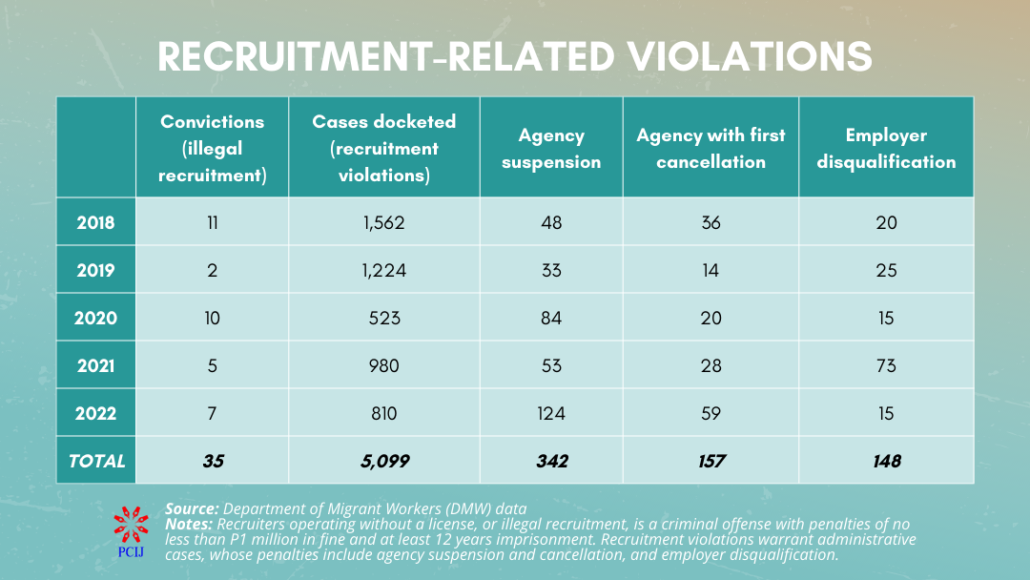

From 2018 to 2022, a total of 35 recruiters operating without a license were convicted and 5,099 agencies were charged with recruitment violations, according to DMW data.

High interest rates

High interest rates in Hong Kong could also be a factor in migrant workers’ debt bondage.

Based on Migrasia’s research, a third of surveyed overseas Filipino workers (OFWs) took on debt that “was larger than their annual household income in order to finance costs associated with migrating overseas.”

“And then you’re talking about interest rates that in Hong Kong often exceed 100 percent. We’ve seen them over 300 percent, which means that if you made the minimum payment you would never get out from underneath that debt. So what do you do? You go borrow more money, right? And then you have a debt cycle that you can’t get out of,” it said.

Lending agencies based in the Philippines have also grown wiser. Instead of running after their Filipino clients, they outsource debt collectors to do the job for them. In cases of “bad debts,” they sell loans to their counterparts in Hong Kong.

Advocacy groups said this was one way to collect excessive fees.

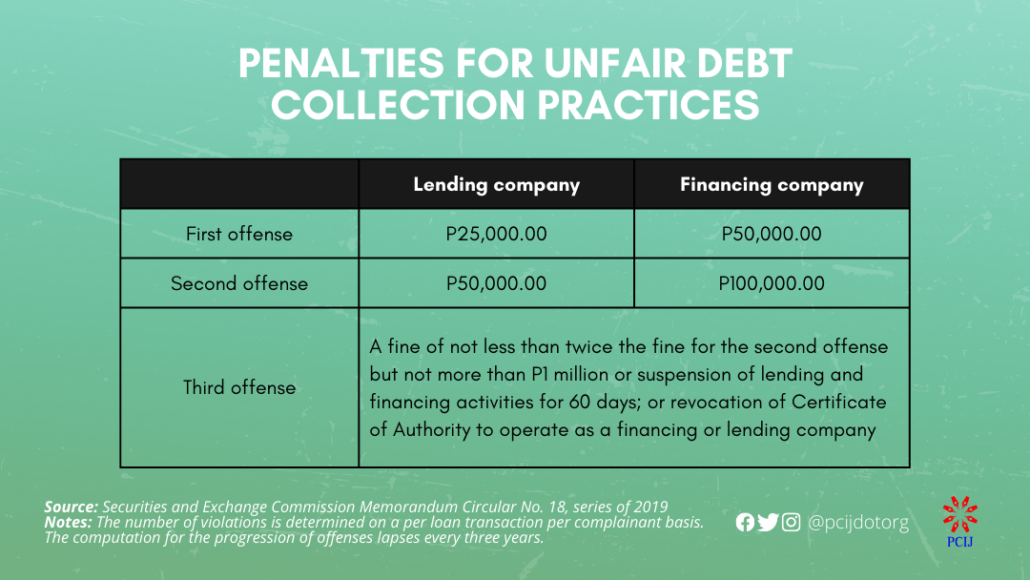

Nolivienne Ermitaño, assistant director of the Securities and Exchange Commission’s Financing and Lending Companies Division, said Philippine lenders and their third-party service providers “should be jointly liable, solidarily liable for that.”

“That won’t work. You (lender) are still part of it because you were the one who talked to the borrower in the first place. You can’t say you’re not responsible for that anymore,’’ he said.

On average, OFWs would take more than nine months and spend a fifth of their monthly salary for debt repayment. But some reported a repayment period of as long as three years, a year longer than the contract of household service workers, according to Migrasia data.

OFWs need more guidance

Officials said migrant workers need to do their due diligence before processing pre-employment papers and verify the legitimacy of licenses of recruiters and lenders with the regulatory authorities.

The DMW website lists licensed recruitment agencies for both land-based and sea-based overseas jobs. The list includes agencies that were closed or permanently banned, and agencies with canceled or suspended licenses.

The SEC website also lists lending companies and financing companies that were issued Certificates of Authority.

Ermitaño acknowledged that OFWs’ circumstances may “induce (them) to suspend their financial prudential thinking.”

But he said that migrant workers have to be “discerning” and “skeptical” to preempt predatory practices and debt bondage.

The Philippine Overseas Employment Administration (POEA), now absorbed by DMW, had identified fees to be shouldered by household service workers and by employers. This should serve as a guide to Filipino applicants.

Olalia stressed that expenses that may be charged to the employer are neither reimbursable nor deductible from a worker’s pay.

Not all violators are punished

Advocacy groups identified several mechanisms for migrant workers to seek redress for their grievances.

They noted that DMW offers legal assistance and conciliation services; SEC accepts complaints on unfair lending practices; the Department of Labor and Employment processes money claims, and courts hear illegal recruitment complaints.

Workers living in far-flung areas can request assistance from the Public Employment Service Office, a multi-employment service facility maintained by local governments, community-based organizations, and state universities and colleges.

But here lies the problem: Not all migrant workers are aware of their options.

“They are not informed, they are not aware, and if you’re not aware of your rights, you cannot invoke your rights,” DMW’s Olalia told PCIJ.

The undersecretary said the OFW could file a complaint; otherwise, the department could launch an investigation on its own.

DMW can provide legal aid to the worker, from the preparation of his affidavit to the prosecution of the case. Otherwise, it can investigate his complaint on its own, requiring the worker to serve only as a witness, Olalia said.

But based on the SEC’s experience, many workers do not push through with their complaint once the issue comes out in the media and the harassment from the lenders or recruiters stops.

“Mabilis ba? (Is the action fast?) What will it take from my (OFW’s) end? Gaano ba katagal ‘yan? (How long will it take?)” said Ellene Sana, executive director of Center for Migrant Advocacy (CMA), a Quezon City-based non-profit organization promoting the welfare of OFWs and their families.

She pointed out that the bureaucratic process would also require time, energy, and money from complainants. Besides, she added, there’s a host of issues that “will make the worker think twice or thrice whether to pursue [a case] or not.”

Sana also agreed that many workers were aware of recruitment violations but sometimes went along with these out of “desperation to get the job.” END

= = = = =

Illustration by Luigi Almuena

This story was produced as part of the Trafficking Inc. investigation by journalists from the International Consortium of Investigative Journalists, The Washington Post, NBC, WGBH Boston, Arab Reporters for Investigative Journalism, the Philippine Center for Investigative Journalism, and the Investigative Reporting Program at the University of California, Berkeley.

This new PCIJ series follows a two-part report on the fight of Filipino migrant workers for equal pay abroad.